If you sell online, Amazon FBA, TikTok Shop, Shopify, you’re not just shipping products, you’re taking on risk.

A competitor launches a lawsuit against you, a customer injures themself with your product, or a contractor tries to sue you for misclassifying them.

Any one of these scenarios can threaten the business you’ve worked so hard to build.

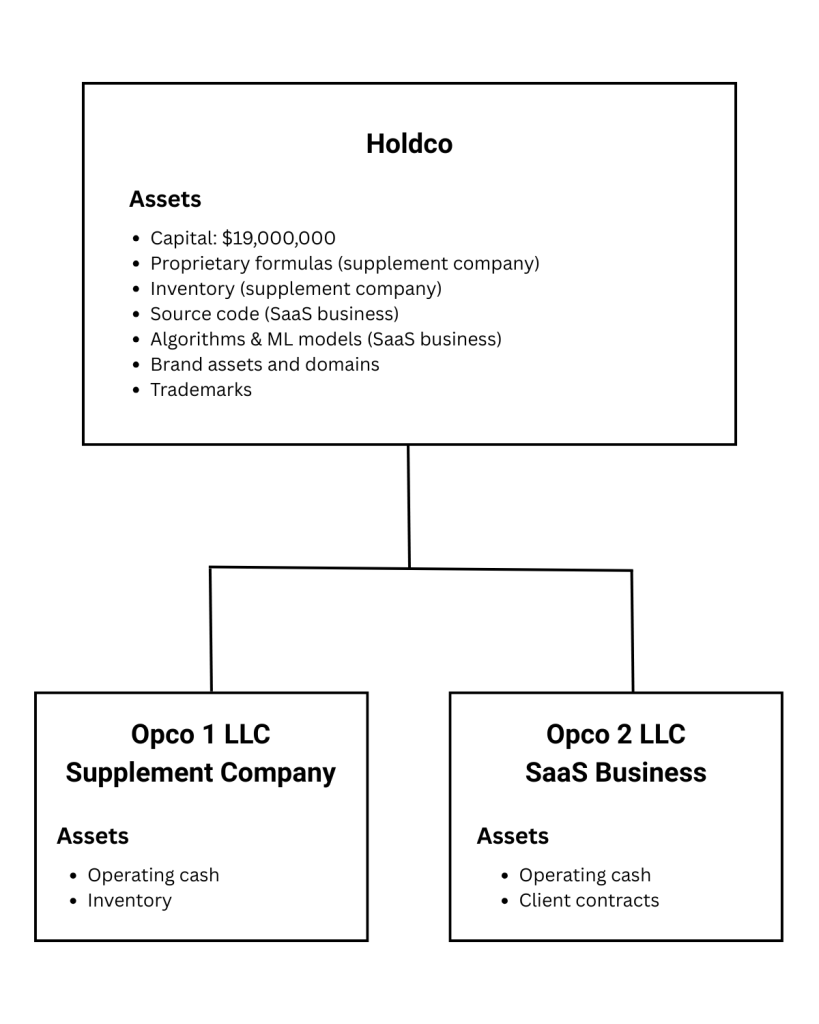

This is why smart entrepreneurs often use the Holdco / Opco structure to protect assets and limit risk.

What is a Holdco / Opco structure?

In simple terms, it splits your business into two or more separate companies: a holding company and operating companies.

1. The Holdco (Holding Company)

The Holdco is the quiet one in the background. It doesn’t talk to customers or run ads. It just owns stuff, like:

- Trademarks

- Brand assets and domains

- Software source code

- Proprietary formulas

- Most of your inventory

- Capital and investments

2. The Opco (Operating Company)

The Opco is the one in the arena. It’s the LLC that actually:

- Sells products or services

- Deals with customers, returns, disputes, etc.

- Signs contracts

It only holds what it needs to operate, for example:

- Operating cash

- Limited amounts of inventory

Note: You can have multiple operating companies operating under your holding company.

If you end up in legal trouble and one of your operating companies gets sued, only the assets held in the operating company are at risk.

Other valuable assets, such as the brand assets, intellectual property, domain names, and most of your money, are sitting in the Holdco and remain protected from the lawsuit.

Why smart e-commerce founders use the opco / holdco setup

Asset protection: keep high-value assets (IP, brand, capital) separate from entities that are most likely to get sued.

Tax optimization: The Holdco can license the brand or charge management fees to the Opco, lowering taxable income.

Exit strategy: You can easily sell one Opco or let investors buy in without touching the Holdco or your other brands.

How it works in the real world

Let’s say you run two businesses:

- An Amazon FBA supplement brand

- A marketing analytics SaaS company

Both are set up as Wyoming LLCs, and both are owned by your Holdco.

Now imagine one batch of supplements has an issue, a customer gets sick, and their lawyer comes knocking.

They successfully sue the supplement company (Opco 1), which holds some operating cash and inventory, so those are the only assets on the line.

Your SaaS company (Opco 2) isn’t touched because it’s a separate legal entity.

Meanwhile, your Holdco, which sits above both operating companies, owns the most valuable assets, such as your trademarks, brand assets, source code, algorithms, proprietary supplement formulas, and most of your capital.

Because neither the Holdco nor Opco 2 are separate legally entities from Opco 1 and never interacted with the customer, their assets are insulated from the claim.

Is a Holdco / Opco structure right for you?

If you’re just getting started, a structure like this is overkill.

But if you’re:

- Doing high sales volume

- Investing in brand and IP

- In a high-risk market

- Preparing for investment

- Preparing for an exit

- Starting a new venture

Then getting the structure right early can save you a lot of pain down the line.